Cross-Border M&A Strategy and Deal Planning Essentials

By GPMIP Partner, Michael Holm, an excerpt from our new book, Cross-Border Mergers and Acquisitions

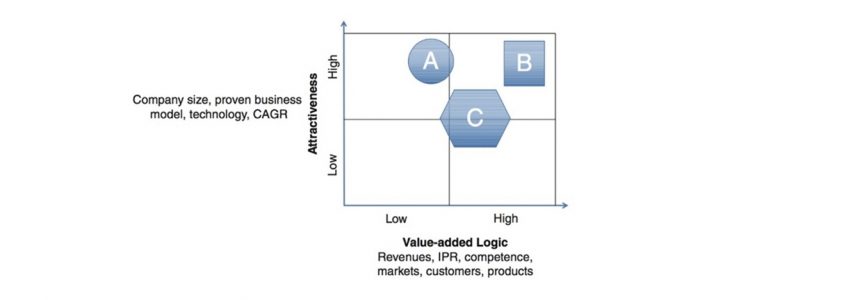

What is the difference between a domestic and cross-border deal when you plan for the transaction? An acquirer might be outside the comfort zone when going into new markets or geographies and perhaps need to have more resources in screening, research, evaluation and due diligence to put together a deal. The components of the M&A strategy need then to be well articulated to set the target criteria that enable an accurate screening process. There are endless variations of what could be the target criteria; size, technology, CAGR, markets etc. The quality and the accuracy of the criteria significantly impacts the end result when you embark on a search and screening of targets.

Above is a view of how 3 possible targets (A, B and C) are mapped against each other regarding the Attractiveness vs Value-adding logic.

The most important in making charts like this during a deal is the common understanding in the deal team after discussing a real target against the criteria setup in the beginning of the screening process.

There need also to be clear responsibilities and accountability in the decision-making process to ensure objectivity in choosing the most optimal target.

What has been your experience with cross-border M&A strategy and deal planning? Comment and “Like” this post on LinkedIn by clicking here.

Interested in learning more about Global PMI Partners? Join us, join our network, or join our mailing list.