Building Your Strategic M&A Vision Using Lanchester and Other Strategies

By GPMIP Partner, Thomas Kessler, an excerpt from our upcomimg book, Cross-Border Mergers and Acquisitions

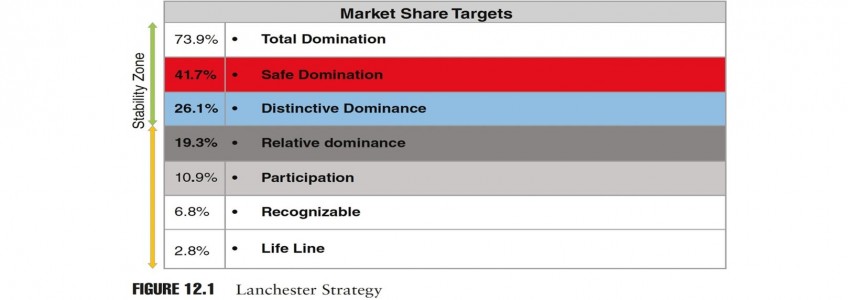

The Lanchester strategy has been developed by F. W. Lanchester as a warfare strategy to identify where to invest existing forces best to achieve the largest territorial gains. Sales and marketing strategists have adopted his tactics to define where they can achieve the largest market share gains given an existing market position and budget (see Figure 12.2). M&A strategists also use the strategy when looking to define those regions and markets where an acquisition will enable a shift in market share and change the companies’ competitive positioning.

The following M&A strategies can be derived from a review of the marketing and sales strategies. Depending on your relative market share and the resources available to you to acquire companies, you may adopt one of the strategies to gain speed and market effectiveness.

Strategy 1

The larger of two competitors has more resources and thus will typically preserve its resources by just defending its market share. The smaller competitor can try to identify an acquisition target to close the market share gap and get into “shooting range” of the larger, resource-rich competitor. This is called buying market share.

Strategy 2

The larger of two competitors has fewer resources and less market effectiveness. There is a high likelihood that the smaller competitor will gain market share organically, thus an M&A strategy would reflect an inappropriate use of resources.

Strategy 3

The weaker force should always try to compete on a narrower front, fight local battles, and increase combat effectiveness. Thus acquisitions in a specific field that close the distance in that specific area are well-invested resources.

Strategy 4

The stronger force should be mindful of the weaker competitor’s tactics and where appropriate adopt them to reduce its advantage and increase resources spent in markets that will stretch the weaker competitor to the breaking point. They cannot fight multiple battles. Thus look toward acquiring in the markets where you cause the biggest stress for the weaker competitor. If the stronger competitor can confuse the weaker one on where to spend its resources, all the better.

Strategy 5

If both competitors are of equal strength, for example, within close “shooting range,” look toward opportunities where you can outnumber your opponent at a critical time by placing your well-positioned choosing. This could be done effectively through a surprise acquisition.

Beside applying the Lanchester strategy, executives can use the GE–McKinsey nine-box matrix combined with the cash value added approach (CVA) as a valuable way to identify strategic fit and define the areas within the organization that best would grow via M&A.

What has been your experience with M&A strategy? Comment and “Like” this post on LinkedIn by clicking here.

Interested in learning more about Global PMI Partners? Join us, join our network, or join our mailing list.