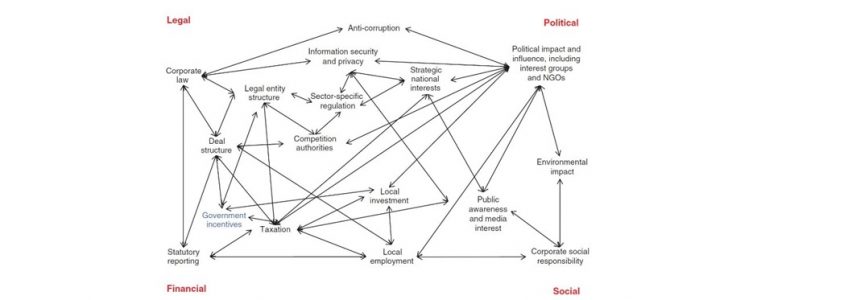

Legal, Financial, Social, and Political Interdependencies with Cross-Border Integration

By GPMIP Partner, Andrew Scola, an excerpt from our upcomimg book, Cross-Border Mergers and Acquisitions

M&A is a complex world. From negotiation, valuation, and rationale, through to completion and integration, we are reminded with each transaction that every deal is different, and each integration will require specific skills and face different challenges. However unique the deal may be there are always numerous inter-jurisdiction, macroeconomic, and social variables surrounding transactions that affect not only the deal itself but also the success of the subsequent integration program.

These factors can be grouped into four categories: legal, financial, social, and political. In the rush to get deals signed, some of the influences and implications can be overlooked or bad assumptions made about them. Case studies on failed cross-border M&As are littered with examples of such failures to recognize and act upon what in retrospect are relatively simple oversights. These can cause risks and issues during integration, erode or destroy deal synergies or, at worst, materially harm the reputation and the market position of the combined business.

The image above shows my simplified view of the web of key legal, financial, political, and social inter-dependencies related to cross-border integration.

I’d been keen to hear about any others that you have found highly impactful to successful cross-border integration. Comment and “Like” this post on LinkedIn by clicking here.

Interested in learning more about Global PMI Partners? Join us, join our network, or join our mailing list.