Industries + Sectors

Private Equity & Venture Capital

At Global PMI Partners we work with clients across many industry sectors. Our approach to consulting necessarily requires teamwork and collaboration with you because we believe that no one external knows your industry or your business like you do. However, private equity and venture capital trends and specifics do impact M&A strategy and execution which vary from other industries. We understand these and bring lessons, customized solutions and proven experience from other private equity and venture capital M&A deals.

Industry trends

- Funds available – strong capacity to invest (cash-in and new funds in 2017)

- Opportunities for consolidation due to technological or other market disruptions

- Increased competition for targets driving up valuations

- PE firms need to create a distinct brand, approach and history to attract targets

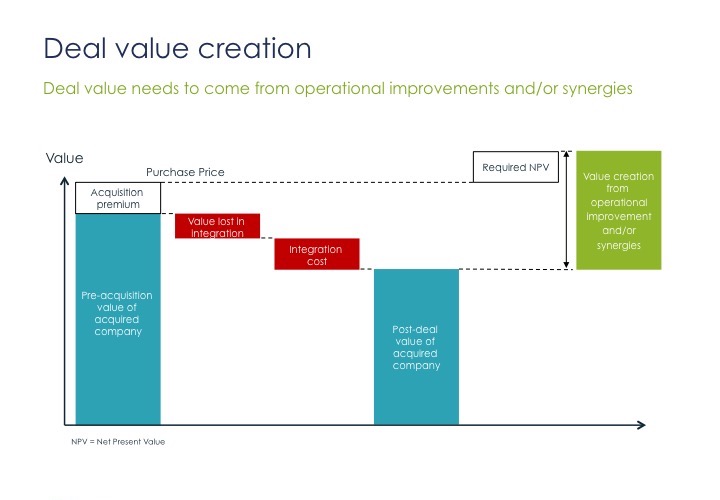

- Value creation depends more and more on operational improvements

- Increased risks to value creation due to higher valuations

- Opportunities to create value across all sectors – case-by-case analysis required

- Unit economics analysis – life time value of customer

- Development of international franchises and investment capabilities

- Development of Chinese investment funds

- Corporate Ventures (CVC) more and more active

- Time to revenue (positive cash flow) focus

- Global political uncertainty and market instability

M&A trends

- More cross-border M&A

- Acquisitions of corporate subsidiaries – carve-outs from major groups

- More auctions meaning limited due diligence, quicker processes and more risks

- Being the 2nd or 3rd Private Equity owner

- More complex deal structures

- Private Equity value chain is evolving to best-of-breed (fundraising, capital structuring, advisors, …)

- Need for Private Equity firms to develop and demonstrate their own successful acquisition history to portfolio company management teams

- Opportunistic acquisitions based on quickly moving political, regulatory, central bank, FX and market changes

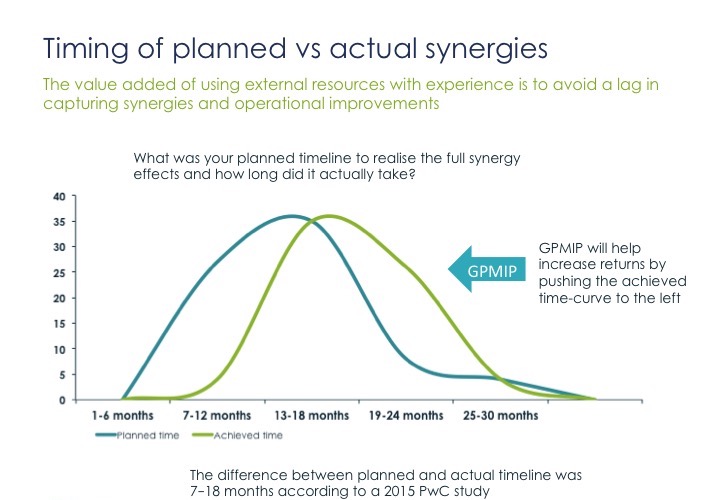

- Increased focus on operational improvement and specialist interims / consultants to ensure synergies and other deal objectives are realized

PMI challenges specific to this sector

- Increased PE management intervention in operations to support portfolio company management through in-house our outsourced Operations Directors.M&A and PMI capabilities in the firms owned – training, playbooks, …

- Integration of carved-out assets (Due diligence, transitional services, interim management, organization design, recruitment, …)

- Each deal is specific

- More competencies on M&A than on PMI

- Bandwidth and experience of portfolio management stretched: 100-day plan execution, new strategy analysis, add-on acquisitions, …

Services for Private Equity firms

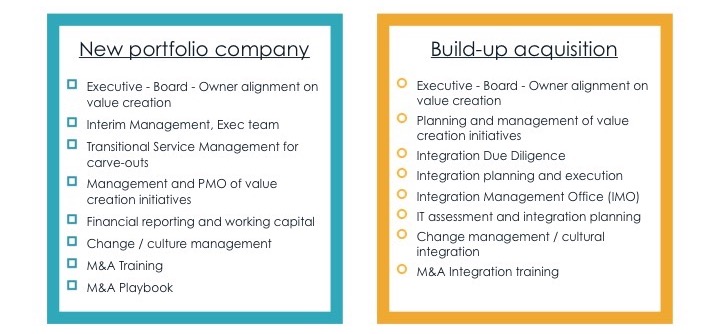

Global PMI Partners offers a range of services to PE firms and the management teams of PE-owned businesses in Europe and the US.

All of our services centre around, and build upon, our M&A expertise.

How we can help

- Training and mentoring of key people in the different participations owned

- Customized playbook and build-up strategy support tools

- Integration DD and PMI support in a build-up context

- Integration DD and implementation support for a carved-out acquisition

- Reorganization – merger between PE’s and funds

- Support and manage 100-day planning & execution of operational improvements

- Outsourced Operations Director

- Interim management

- Support building PE profile by building build-up and PMI capabilities

Why we are the right solution for you

Global PMI Partners is building long-term relationships with Private Equity firms (who recommend us to their portfolio companies) because:

- PE firms want proven and trusted M&A integration expertise on demand

- Our business model is suited to mid-size PE transactions (flexible, low structure costs)

- We have a global presence and local expertise (language, cultural, regulatory, etc)

- Cross-functional expertise covers all workstreams from analysis to implementation

- Strategic C-level consultants equally happy to get hands-on

- We work collaboratively with management teams, PEs, and other advisors

- We provide the perfect deal-specific team every time

- Faster implementation of operational improvements and synergies through focus, structure and GPMIP methods and tools

- We help you improve valuations of portfolio company through developing a successful acquisition track record