Sales Integration – A Regular M&A Experience

By Robert Heaton, Senior Executive Advisor at Global PMI Partners

In mid-2017, a Singapore based mid-market technology vendor had completed the acquisition of a $30M cybersecurity business and through 2018, we worked alongside their leadership team to help manage the post-deal integration.

The purpose behind the acquisition was to ‘buy-in’ cybersecurity expertise and strengthen existing product and services offerings. And despite some obvious synergies and efficiencies, the focal point of value creation over 5 years, was some $20 – 30M in cross-sell and up-sell and increased wallet share per customer.

As you might expect, this required some significant post-deal activity around the sales and marketing functions and in this article, I’ve outlined some of the critical considerations and decisions that needed to be taken to drive immediate and long term value creation. Whilst every deal is different, I wanted to highlight the complexity and the many touch-points that need to be considered in any acquisition and across every function of the business. And furthermore, I wanted to leave you with five take-away recommendations

- Make sure that anyone assigned to the integration task has appropriate experience, and can commit the expected time and effort. Failure can be just around the corner when you task experienced or time stretched people to post deal integration.

- Don’t simplify the task. What may appear to be a simple consideration will invariably impact multiple areas of the business.

- Cultural differences have to be front and centre of early post deal activity.

- Clear and Consistent communication at all levels is vital from Day 1 and throughout the entire post deal integration process.

- Make sure to you act quickly, but fairly on realizing key value creation opportunities.

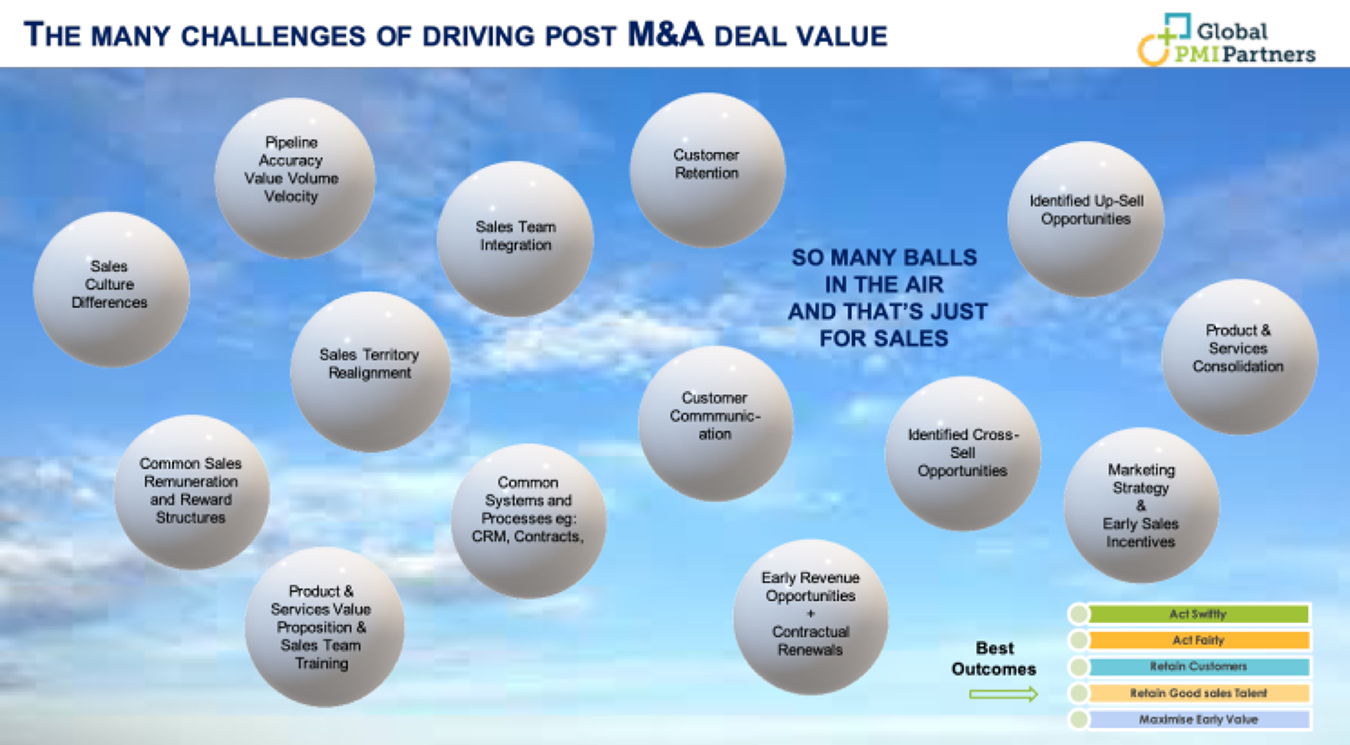

Juggling Skills are Key to Successful Post-Deal Integration

There is one blindingly obvious fact and that is that shareholders will expect business continuity of the core business and the acquired business, so anyone involved in the post deal integration must achieve the anticipated vision and value creation in-situ. A bit like trying to change a tire on your car while you are still driving.

What that means in practice, is there will always be multiple balls in the air and change will be a constant partner for everyone across the business. That again, is reinforcement for the 5 take-away messages and hopefully you will get a feel for the complexity in the following narrative, even though it’s only concerned with Sales & Marketing.

Typical Considerations for Maximizing Value from Sales Integration

Communication – Internal & External

A clear and consistent communication strategy needs to be in place before Day 1. Employees, Suppliers, Customers, all need to know what’s happening and how it might affect them and they will need regular updates as the integration takes effect.

Sales Culture Assessment

If you have one sales team with a ‘win and run’ mentality and another with a ‘win and nurture’ approach, you’re in trouble. Even differences in compensation models can have a huge impact. Early assessment of the sales cultures and sales leadership will one critical to customer retention, future revenue growth and any early contract renegotiations.

Retention of Top Sales Talent

Acquisitions means change, and people will be concerned about their future and will start to look elsewhere. Making sure you identify, reassure and retain your top sales leaders and sales performers will be a task that you have hopefully planned and can put into action on Day 1.

Pipeline Accuracy (Volume, Value, Velocity)

Take a cold hard look at the forward sales pipeline. How accurate is it? Does past pipeline history support the current projections? Other than $value, do you have sufficient volume (number of deals) and velocity (how quickly are opportunities converted to closed business). Communication, Culture and Pipeline challenges will all impact future revenue streams if not addressed early.

Common systems, policies and procedures

It’s day 1 and you’ve got two CRM systems, two sets of policy and differing procedures. Having a plan to move to common systems, policies and procedures will ensure a single face to the customer and reap short and medium term benefits.

Customer Retention

You’ve acquired new customers and you will need a strategy and detailed plan to ensure them of continued loyalty and maintenance of existing agreements. You may also have potential cross-sell and up-sell opportunity. A ‘wait and see’ approach will be painful because your competitors will be circling, hoping to take those undecided customers from you.

Early Cross-sell and Up-sell opportunities

You will need a clear strategy and plan in place to maximise any cross-sell and up-sell opportunity. This could mean defining a targeted marketing campaign, it could mean special customer incentives, and it could involve additional compensation for sales people? Either way, you’ll need a clear idea of how you will maximise this early revenue opportunity. One last point, the new product / service portfolio may also offer opportunity too win new customers.

Sales Team Integration

At some point you may want to combine the sales teams either organisationally, geographically or both. You may take a phased approach and consolidate sales leadership first? You may have cost reduction opportunity by closing some sales locations? Either way, you will want a clear plan of how this will be achieved.

Common quota and commission mechanisms

Whether you tackle this early or incorporate during sales team integration, it will make sense to get all sales resources onto common employment contracts, common revenue targets and commission structures. Careful communication and negotiation may be necessary and this is by far not an easy task. Not only will it need careful planning and communication, you will need to ensure your best leaders are tasked with making this successful.

Product & Services integration including value proposition, pricing etc

How do you intend bringing product and service lines together? Will some be replaced? re-branded? re-packaged? Does the improved products / services change your value proposition? Do you now have a competitive advantage that can be exploited?

Marketing consolidation including immediate and longer term strategies.

How will your marketing department(s) engage with the new acquisition? Can they be instrumental in achieving early revenue growth or entry to new markets? Should they be helping with customer retention? Do you need to reassess your overall marketing strategy? Etc. Etc.

Summary

This article has only focused on post-acquisition activity around the sales function and you can see already that there are many many touch points that need to be considered and planned for. And I’ve only just scratched the surface. The eagle eyed among you will no doubt have a dozen other sales topics that are equally important. What this all means is that post acquisition integration is not for procrastinators nor the faint hearted. Every facet of the business will be impacted in some manner and having experienced people focused on managing value creation will be the best post deal decision you can make.

Apart from the 5 recommendations made earlier, there are three additional messages on which to close:

- Make sure you have highly experienced people in the post-acquisition integration team.

- Your own leadership team are already 100% focused (and incentivised) on their day job, but still need to be accountable for business continuity Using experienced external resources to complement your own people is both cost effective and will drive greater value

- Communicate clear decisions, act swiftly but maintain fairness at all times and you will maximise the value creation that is available from your latest acquisition

I hope we have given you fore thought on this topic. We are always ready to discuss M&A projects and how we might complement your people on your next acquisition.

Robert Heaton is a Senior Executive Advisor for Global PMI Partners, specialists in post-merger integration and carve-outs.

He is a Technology Industry veteran, and has held Sales & Operations leadership positions in Europe, North America and Asia Pacific for technology leaders SAP, J.D. Edwards, and Cisco. Prior to that, Robert worked in Production Management for Dunlop before spending 10+ years consulting on technology adoption to manufacturing and logistics businesses across Europe.

He is a specialist in Mergers and Acquisitions, helping companies prepare for sale/divestment or integrating acquisitions to maximize synergies, efficiencies and overall value creation.