Small M&A Boutiques Have Changed the Deal Market, Consulting is Following

By GPMIP Partner, Andrew Scola

The Financial Times published a really interesting article on 25 Jan 2017 called Boutique advisers maintain their client appeal about the rise and rise of small M&A firms at the expense of the “traditional” investment banks.

Dealogic reckon there are 3,800 houses working on M&A deals. Most of these were founded by the most successful “very senior” investment bankers, “superstars” as the FT calls them. They are entrepreneurs that have realised that the advantages of an M&A boutique, independence and discretion, outweigh the disadvantages and challenges of being small. They normally don’t need the money but set up smaller firms because they have a passion for what they do and value serving clients over profit.

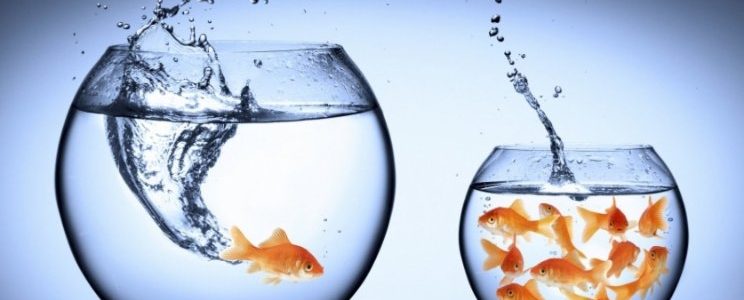

So it is with the less publicised post-deal side of mergers and acquisitions, and the consultants and consultancies that perform post-merger integration.

The large strategy, audit and consulting firms have eminent M&A advisory and consulting practices, built by cross-selling M&A services to existing clients. These traditional firms have used their brands to win and service the lion’s share of carve-outs and integrations. With established methodologies and leveraged staffing models, they are rigorous and reliable.

However, the knowledge economy has transformed the consulting landscape, reducing the advantages of the traditional consultancies along with the barriers to entry. Although contractors and interims have been around for longer, the true disruption started around the turn of the millennium with the birth of a new kind of consulting model. Firms like Global PMI Partners and Eden McCallum started to pull together excellent teams of independent consultants from their network, organised by internal Partners that provide the glue and the governance. They are transforming how the best projects are resourced from strategy to technology consulting. In the highly specialised M&A area, consultancies are at least a decade behind the deal-making boutiques, but they’re catching up fast.

“Post-merger integration is no longer dominated by the traditional consulting firms. A few small consultancies specialising in M&A are increasingly winning work with private equity and corporate clients who are looking for a better alternative”

Who am I and why am I qualified to have an opinion on M&A consulting? I have worked in 3 top-tier consulting firms, where like so many other graduates I learnt about the consulting industry and built my experience and my expertise. After leaving ‘big consulting’ I worked on the client side as Head of Acquisition Integration for a healthcare company and I subsequently led two small M&A consultancies.

So, having seen the pros and cons of each model first hand from several angles, I’ll share my view of the relative appeal of working with the M&A teams within traditional consultancies vs. small PMI consultancies.

Benefits of traditional strategy, audit and consulting firms:

- Brand recognition and the risk mitigation that brand protection efforts within these firm would provide

- Scale, on the assumption that the team of available resources with relevant M&A skills is large because the organisation itself is huge

- Guarantee of quality because of the consistency of intelligent consultants and established methodologies

- Ease of resourcing because established relationships and contracts for other services (e.g. audit) make requesting M&A consulting simple

Benefits of small specialist M&A consultancies like Global PMI Partners

- Focus on M&A specialism and competence and the expertise that follows from this on an individual and organisational level

- Experience of the client-facing individuals, enabling smaller expert project teams (less juniors)

- Value of the services because of the efficiency and expertise, coupled with lower structural costs and typically more transparency on costs

- Choice of professionals within the network allowing clients to pick team skills and profiles with precise requirements tailored to their needs

- Flexibility and agility of a smaller (hungrier) firms makes working with them more suited to the client’s needs than that of the consultancy

- Cultural fit can be found (less consultant-like?) and better attitude in terms of collaboration with client teams and third parties

- Transfer of knowledge in-house because consultants are embedded in client teams, not a separate suited clique

- No conflicts of interest or cross-selling (which clients hate)

As with the M&A boutiques, the advantages of working with a small M&A consultancy far outweigh the drawbacks. M&A methodologies and talent acquisition are highly commoditised and widely distributed now, and the scale advantage is illusory by the time you account for staff utilisation and insufficiently skilled and/or junior staff that add less value. So, what’s left is risk mitigation and fairly lazy sourcing practices. Clients working with the traditional consultancies are conservatively choosing security over expertise, value, innovation and style. They should aim higher given the importance of operational merger integration to the achievement of deal objectives and synergies.

We summarise the differences in this simple graphic:

The last advantage that smaller companies everywhere benefit from is that they are consistently underestimated. One of the traditional investment bankers told the FT that “the only business proposition [of a boutique] is the individuals … they don’t have a future”. Well, I believe that people make the difference. In a professional services industry, where the success or failure of your deal is overwhelmingly dependent upon the very personal experience and capabilities of your key advisers, I think that these companies centered around brilliant individuals have a bright future – no wonder they’re killing it already!

Please let me know your thoughts, whether you agree or not and if you work in M&A or another area. Feel free to contact me at andrew@gpmip.com to start a conversation, have a look at Global PMI Partners’ website or blog.

If you fancy a lighter take on big vs. small consulting differences do have a look at our infamous explainer video.

What are your thoughts on how small M&A boutiques have changed the deal market? Comment and “Like” this post on LinkedIn by clicking here.

Interested in learning more about Global PMI Partners? Join us, join our network, or join our mailing list.