Why copy & paste will not work with post-merger integration

By Sergio Bruno, Italy Partner at Global PMI Partners

“We’ve already done one integration 3 years ago – we know what we have to do”.

“Who hasn’t gone through an integration in his/her professional life? We’ll simply reapply the experience we had in the past”

“We already have a checklist of the activities to be done – we copied it from another project. We do not need any specific support”

These are examples of what we often hear when we start working on a Post-Merger Integration (PMI) Project. No need to say that, if you base your approach to a new integration project, simply by copy and pasting the experience you had in the past, the probability of a failure is very high. There are several methods and techniques that are useful across different integration projects and can be exploited to expedite the project.

Methodology is fundamental to give a global framework and to create efficiency, but methodology alone is not enough: it must be adapted to the specific features of every single project. What are the major areas of difference between PMI projects? What cannot be simply copied and pasted from one project to another? The differences between projects arise from how companies answer basic questions about how they want to integrate, i.e. what approach they want to follow.

Let’s look at these questions/approaches from different perspectives. For the sake of simplicity, we will consider only these five Perspectives:

- Strategy

- HR

- ICT

- Marketing & Sales

- Production and Supply chain

The complete detailed scenario should also include other perspectives such as Legal, Tax, Finance, and R&D.

Strategy perspective

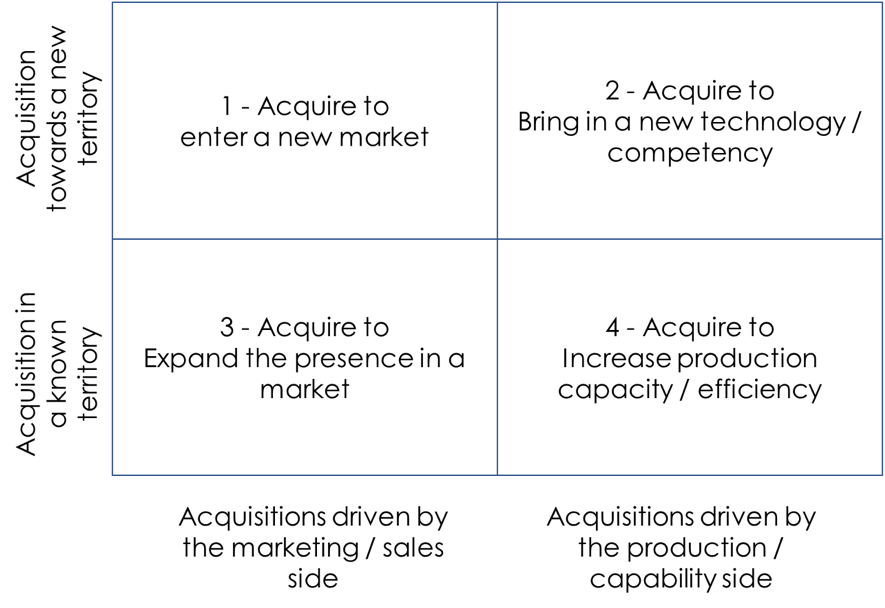

Why Company-A is acquiring Company-B? There are many answers to this question! This matrix summarizes them:

1) A company wants to enter a new market quickly by acquiring a company that already has a good portfolio of clients in that market

2) A company wants to acquire a new technology and/or competency quickly by acquiring a company that already has that specific technology and/or competency

3) A company wants to expand its presence quickly in a market where it is already present by acquiring a competitor

4) A company wants to increase its production capacity quickly while creating efficiency by acquiring another company with similar production and/or supply chain

On top of these categories, a fifth category is often seen that does not support growth:

- defensive acquisition (buy before someone else buys you);

- opportunistic acquisition (buy a company that needs money and that can be bought at a cheap price);

- ego driven acquisition (a company buys another company to show its muscles to the market/competitors and to please the ego of the management/owners);

Many integrations are a combination of one of more of these basic categories.

We must be aware of the strategic reasons behind a merger, since different reasons mean different implications in all the steps of the integration.

Note that a recurrent theme is speed: in a PMI project, the respect of the deadlines is very important.

Let’s consider this example: if a company wants to enter a new market, the company could grow organically in 3 years. They decided to grow by acquisition in order to take only 1 year. If the PMI projects takes 3 years, then the reason behind the acquisition itself could no longer be valid.

HR perspective

“What will happen to the people of the acquired company?” is the most common question we hear. Unfortunately, the answer to this question is important, as well as all of the human emotions related to how/when/by for whom the answer is communicated.

There are different approaches:

- Keep everyone (zero synergies)

- Identify and keep key resources of the acquired company

- Hire some new managers for the merged company from the external

- Each approach again has different implications on the PMI project

Culture

Merging the cultures of two companies is very difficult. Companies are made by humans and humans have a huge set of unwritten rules, attitudes, and behaviors that contribute to the creation of the cultural identity of a company.

How can we manage the merged company culture?

There are several examples of integration challenged by cultural issues not correctly identified and addressed:

- family-owned business is merged into a multinational listed company;

- European company is merged into a far East company;

- Small highly skilled entrepreneurial start-up is merged into a conglomerated company

Values

Values are sometimes an “internal marketing tool” or a set of “nice words” that represent ideals that a company would like to have. In other cases, there are values (maybe not in written form) that are very strong and denote the “style” of a company.

What will happen to the values of the companies involved in the integration?

On a more material level: what are the compensation and career policies of the merged company? What happens if the salaries of the two companies were different for the same organization level?

ICT Perspective

What is the status of the ICT in the two companies? What will be the target of ICT after the merger? In some cases, the ICT systems are similar and in other cases, they are quite different, and the integration of the ICT systems becomes a real project in the project. There are also different strategies to determine the target ICT systems.

In many cases, the target ICT system is the ICT system of the acquirer. This has the advantage of working on a well-known system but has the disadvantage to lose any potential strength of the system of the acquired company. Another approach is to define a target that is a combination of the two systems. In this case, the disadvantage is, typically, the interface between the different applications.

A third approach is to take the occasion of the integration and migrate both systems to a completely new one. This means added complications to the integration project, but has the advantage to concentrate on all the changes to the organization.

Marketing & Sales perspective

What will happen with the brands? The brand of the acquired company will disappear? Remain? Coexist for a while? For example, we can look at the merger of the national mobile companies into Vodafone. At the beginning were the local brands, second phase: the local brands + Vodafone logo, third phase: the logo Vodafone + the local brands, last phase: only the Vodafone logo.

In some cases, it is important to keep the original brands and keep them more or less separated. Take the example of the brands of the Volkswagen group (Audi, VW, Seat, Skoda). What will happen with the sales network? A salesman the former Company-A will continue to sell products only of Company-A or will sell products of both companies? What about discounts, terms, conditions, commissions, etc.

Production and supply chain perspective

What are the advantages of keeping the production and supply chain departments of the two companies separated versus merging them into one only department? In many cases, during the due diligence phase, there is an estimate of the synergies. “Synergies” is a politically correct word to mean “lay off”. So basically, what happens is that if company A has X workers and company B has Y workers, then the merged company will have less than (X+Y) workers. This means produce the same with less people, i.e. increase EBITDA.

Unfortunately, it is not always as easy as that. Companies are made by humans and human reactions must be managed very carefully. So, you can create synergies without decreasing production… but you must keep Production PMI in synch with HR PMI, then you must keep your marketing position without any discrepancy, this means you must synch also with sales PMI; of course, the underlying IT must be aligned, which means synch with ICT PMI and so on…

Conclusions

- There are many differences between two PMI integration projects, from the strategy behind the integration, to HR, ICT, Sales, and Production.

- These differences generate different questions to be answered and choices to be made.

- There is no golden answer to these questions. Every choice has its pluses and its minuses.

- The combination of the answers will make each integration project unique.

- Methodology is fundamental to create a framework that generates efficiency.

- Methodology alone is not enough; it must be adapted to the circumstances of each individual project.

- For these reasons, copy-paste does not work in PMI.

Sergio Bruno is Partner with Global PMI Partners, an M&A integration consulting firm that helps mid-market companies around the world bring their operational, technical and cultural differences into alignment. Global PMI Partners has a reputation for delivering exceptional consistency, speed & customized execution on the complex operational, technical and cultural issues that are so critical to M&A success.